The Morinaga Group will enhance its corporate governance with the aim of maximizing corporate value and achieving enduring corporate growth based on the basic policies of improving the health and efficiency of management, ensuring the reliability of its financial position, providing timely and appropriate disclosure of information, complying with laws and regulations, and strengthening the trust and relationships with all stakeholders.

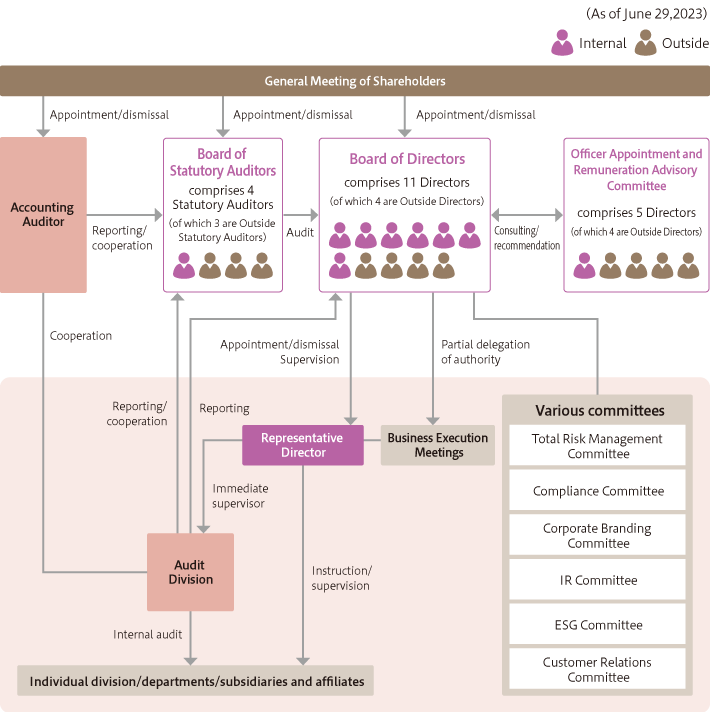

Morinaga’s “Rules on Decision-Making Criteria” states clear definitions of authority and responsibility for respective decision-making units, including the Board of Directors, Business Execution Meetings, Directors, Executive Officers, and General Managers of individual divisions and departments.

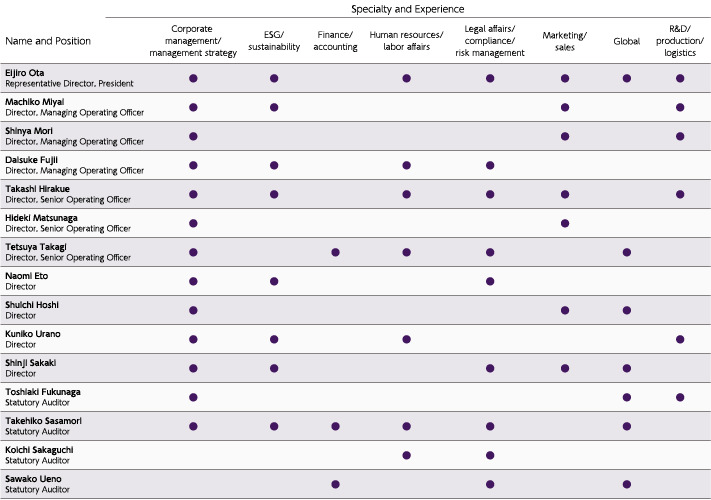

(As of June 27,2025)

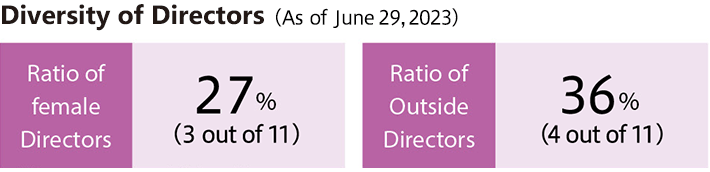

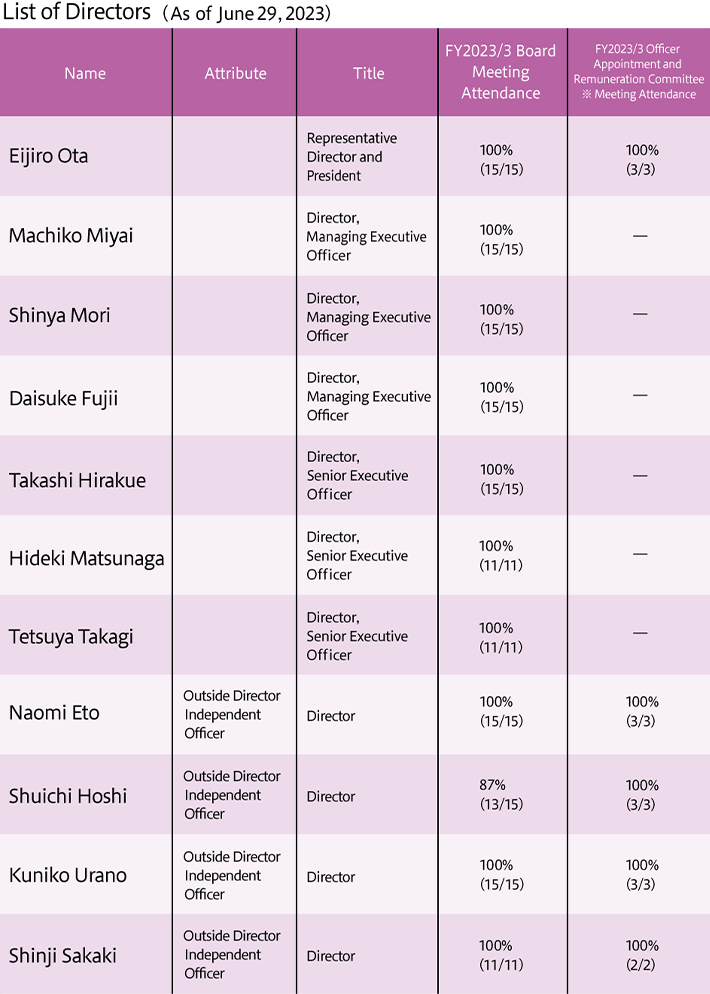

The Board of Directors deliberately makes decisions on statutory matters and the execution of important business based on the business judgment principle and supervises the execution of business. The Board consists of ten Directors, out of which four are Outside Directors, eight are male, and two are female Directors.

Business Execution Meetings, which is mainly comprised of Directors,Senior Operating Officer and Standing Statutory Auditors, deliberates and makes decisions on the execution of business and important management themes. To ensure the effectiveness and efficiency of deliberations at the Board of Directors and Business Execution Meetings, sufficient prior discussions are made at various committees that serve as advisory bodies for the Boards. These committees include the IR Committee, which is concerned with information disclosure, and the Officer Appointment and Remuneration Advisory Committee, a forum to discuss matters concerning Directors’ personnel and remuneration matters.

With the aim of increasing the agility to respond to the changing business environment and accelerating the decision-making process, Morinaga has adopted an executive officer system. With this move, the Company delegated authority and responsibility for executing regular business relating to the implementation of strategies to Executive Officers, ensuring efficient management and a clarification of responsibilities for business execution.

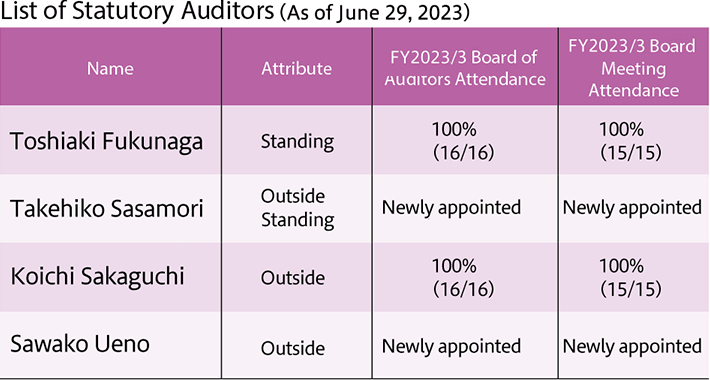

We have four Statutory Auditors, including three Outside Statutory Auditors. One of these three Outside Statutory Auditors is a Standing Statutory Auditor, and three of Statutory Auditors are male and one is female. In accordance with the Guidelines for Auditors, Statutory Auditors audit the Directors’ performance of their duties based on the Rules on Statutory Auditors’ Audit. Standing Statutory Auditors hold regular meetings with the Representative Director and attend Board of Directors, Business Execution Meetings of the Board of Directors and other important gatherings to audit the Directors’ performance of their duties. Audit Division, which is responsible for carrying out internal audit, directly reports to the President. Composed of seven members, the Division audits all divisions (including subsidiaries) in a planned manner, and exchanges opinions with the divisions jointly with Standing Statutory Auditors. To ensure close cooperation, opinion exchange sessions are held regularly and as needed basis between all Statutory Auditors and the Accounting Auditor, as well as between Standing Statutory Auditors and the General Manager of the Audit Division. The General Manager of the Audit Division and the Standing Statutory Auditors attend the meetings of the Internal Control Steering Committee, which is composed of members selected from major divisions and departments, and exchange opinions with the Committee members on a regular basis. Furthermore, the Audit Division enhances the effectiveness of internal audits by reporting directly not only to the President, but also to the Board of Directors and the Board of Statutory Auditors, as necessary and appropriate. Morinaga appointed Deloitte Touche Tohmatsu LLC as its accounting auditor.

In order to realize the Group’s purpose and vision, as well as its 2030 Business Plan and the Medium-Term Business Plan, we have specified the specialized knowledge and experience particularly expected of the Company’s Directors and Statutory Auditors as follows. When selecting candidates for Directors and Statutory Auditors, we give consideration to ensuring the balance and diversity of human resources who possess these skills.

Note:The ● symbol is included in the relevant items if the officer possesses specialized knowledge and experience, such as having background as a business manager in each field.

| Skill | Reasons for selection |

|---|---|

| Corporate management/Management strategy | To build appropriate management strategies and make responsible management decisions in order to achieve the sustainable growth of the Group while responding to changes in the business environment |

| ESG/Sustainability | To co-create with stakeholders to resolve social issues related to our business, and to improve the corporate value of the Group and realize a sustainable society |

| Finance/Accounting/DX | To enhance our ability to generate funds through management practices that are conscious of optimizing capital costs, and achieve stable and continuous shareholder returns, and to strengthen our management foundation and sustainably improve corporate value by investing in digital technology, etc. |

| Human resources/Labor affairs | To promote the active participation of diverse human resources and realize the happiness of employees based on a relationship of mutual trust between the Company and its employees, and to create new value and achieve the sustainable growth of the Group |

| Legal affairs/Compliance/Risk management | To establish an appropriate risk management system, promote compliance management, build and maintain the management foundation of the Group |

| Marketing/Sales | To accurately identify changes in the business environment and changes in consumer needs, develop management strategies in response, and improve our brand value and corporate value |

| Global | To strengthen the foundations for overseas expansion while understanding and respecting local cultures, and promote further global expansion in order to realize a richer and healthier eating habits for people around the world |

| R&D/Production/Logistics | To promote structural reforms, strengthen our business foundation, and establish a system for competitive advantages in order to create new value based on technology, respond to changes in the business environment, and improve profitability |

An overview of the Executive Appointment Policy is as follows.

The Company shall determine that Outside Directors, Outside Statutory Auditors, and candidates thereof are independent provided that they do not fall under any of the following categories.

In FY2025/3, the Board of Directors discussed the following matters as main topics.

| Topics | |

|---|---|

| Management strategy and sustainability-related |

|

| Governance-related |

|

| Compliance and risk management-related |

|

| Finance, investment, and loan-related |

|

1. Basic Policy

The Company’s Executive Remuneration Basic Policy is as follows.

2. Content of Executive Remuneration System

Remuneration for executive officers is composed of fixed remuneration and performance-linked remuneration. Performance-linked remuneration accounts for 30% of a total remuneration to be paid in the event of achieving business indicators by 100%.

The Company’s basic approach to the breakdown of the percentage of each type of remuneration for each executive category is as follows (assuming the rate of achievement of business targets is 100%).

| Executive category | Fixed remuneration | Performance-based remuneration | |

|---|---|---|---|

| Monetary remuneration | Stock compensation (non-monetary remuneration) |

||

| Executive Director | 70% | 20% | 10% |

| Executive Director (non-resident of Japan) |

70% | 30% | - |

| Outside Director | 100% | - | - |

| Statutory Auditor | 100% | - | - |

3. Matters concerning Resolution by the General Meeting of Shareholders about Remuneration for Directors and Statutory Auditors

At the 175th Annual General Meeting of Shareholders held on June 29, 2023, it was resolved to revise the maximum amount of remuneration for Directors from 500 million yen per annum (including 40 million yen per annum for Outside Directors) to 500 million yen per annum (including 80 million yen per annum for Outside Directors). (The number of Directors immediately following the conclusion of the said General Meeting of Shareholders was 11, including four Outside Directors. Director remuneration does not include any employee salary.

Moreover, separately from the said monetary remuneration, at the 170th Annual General Meeting of Shareholders held on June 28, 2018, the introduction of a performance-linked stock compensation plan using a trust for Directors (excluding Outside Directors and non-residents of Japan) was approved. The maximum amount of cash to be contributed by the Company to the trust for each target period covering three fiscal years was resolved to be \180 million in total, and the maximum number of points to be awarded as stock compensation was resolved to be 15,000 points for one fiscal year. The Company adjusted the number of shares of the Company's common stock to be delivered and granted per point, in consideration of the stock split for the Company's common stock that took effect on January 1, 2024. The number of Directors (excluding Outside Directors and non-residents of Japan) at the conclusion of the said General Meeting of Shareholders was 8.

The maximum amount of remuneration for Statutory Auditors was resolved at the 169th Annual General Meeting of Shareholders held on June 29, 2017 to be 80 million yen per annum. The number of Statutory Auditors at the conclusion of the said General Meeting of Shareholders was 4.

4. Policy on Determination of Remuneration for Individual Directors

The level of remuneration is verified by the Officer Appointment and Remuneration Advisory Committee based on the Company’s financial performance, taking into consideration the remuneration level, etc. of peer companies or those of similar size as the Group.

5. Matters concerning delegation of authority concerning determination of remuneration for individual Directors

The Company's Board of Directors resolved to delegate to the Officer Appointment and Remuneration Advisory Committee, which consists of all the Company’s Outside Directors and the President, the authority to determine details of remuneration for individual Directors. The reason for the delegation is to ensure objectivity and fairness in determining the amount of remuneration for individual Directors. The Officer Appointment and Remuneration Advisory Committee makes its determination after deliberating the proposal on the amount of remuneration for individual Directors prepared by the President, including performance evaluations, and reports the determination process to the Board of Directors.

Regarding stock compensation, which is non-monetary compensation, its maximum amount is the amount resolved at the General Meeting of Shareholders, separately from monetary remuneration. The Company awards a certain number of points to Directors (excluding Outside Directors and non-residents of Japan) in accordance with the provision of the “Share Delivery Rules” following consultation with the Officer Appointment and Remuneration Advisory Committee and receiving its recommendations.

The Company will place particular emphasis in working on the following matters as future issues as part of ongoing efforts to further improve the issues identified in the previous fiscal year :

“We aim to further enhance discussions relating to medium- to long-term management issues by selecting appropriate topics and ensuring time for deliberation.”

Based on this effectiveness evaluation of the Board of Directors, we will further improve the effectiveness of the Board of Directors of the Company, and further strengthen corporate governance, including by taking the necessary initiatives to improve the above issues.

The Morinaga Group is committed to maximizing corporate value and achieving an enduring corporate growth by strengthening our internal control system, increasing the management efficiency, operating its business properly, and ensuring effective supervisory and audit practices. To ensure appropriate execution of duties, the Board of Directors endeavors to establish an effective internal control system as well as a system of compliance to legal requirements and internal rules including the Articles of Incorporation, while Statutory Auditors are responsible for auditing the effectiveness and functionality of such systems. In addition, Morinaga and its subsidiaries home and abroad have introduced a helpline to collect a wide range of information about compliance issues take appropriate measures against them.