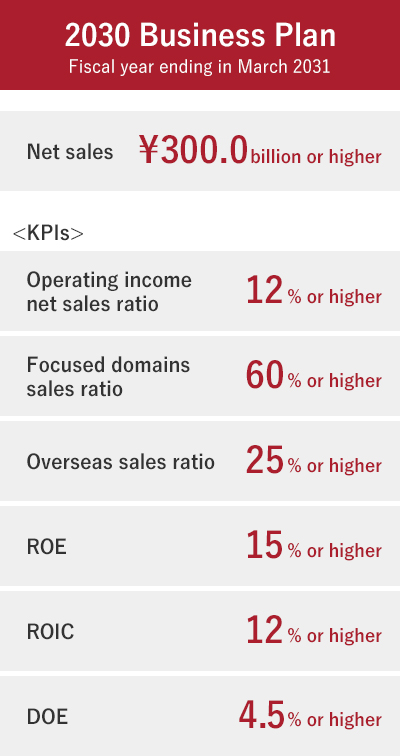

To guide us as we grow steadily over a medium to long term and raise its corporate value under our new Corporate Philosophy while contributing to the realization of a sustainable society, the Morinaga Group has formulated the 2030 Business Plan for the long term up to 2030. In this plan, we will integrate vitally important management issues both financial and non-financial and practice sustainable management.

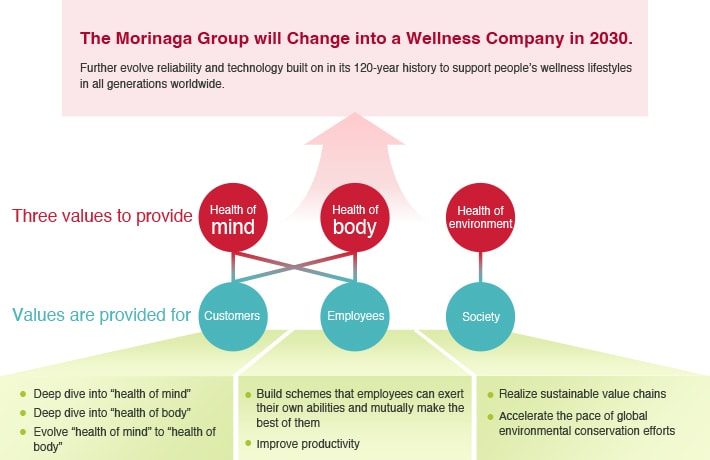

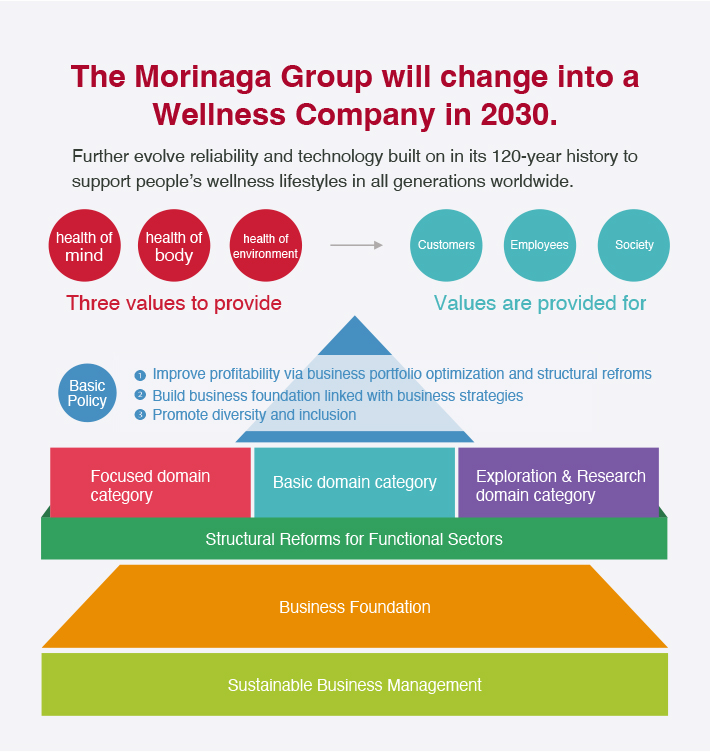

To express the state that we intend to reach in 2030, we have formulated our 2030 Vision, which reads: “The Morinaga Group will change into a wellness company in 2030.” Defining wellness as a state where, based on a healthy mind, body and environment, one pursues and achieves a truly fulfilling, rich life, we will endeavor to become a company that will continue providing our customers, employees, and society with the three values of the health of the mind, the body, and the environment. We will further evolve reliability and technology built on in its 120-year history to support people’s wellness lifestyles in all generations.

Morinaga’s Concept of “Health of Mind”

We have formulated three basic policies and business plan based on the backcasting approach

Policy 1

Improve profitability via business portfolio optimization and structural reforms

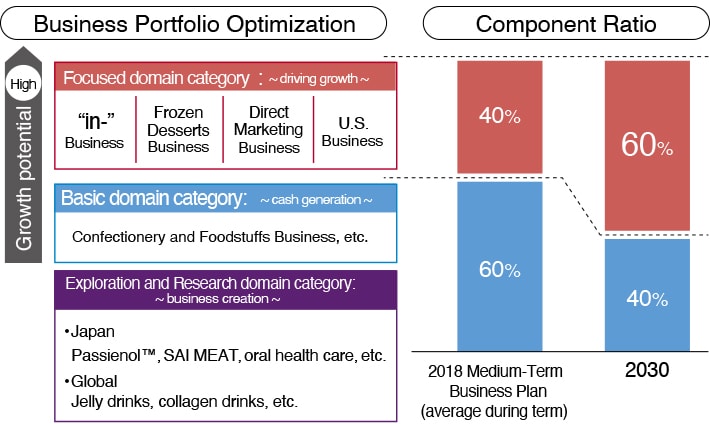

We have chosen the “in-” Business, that is centered on in Jelly and other “in-” brands, as well as Frozen Desserts, Direct Marketing, and the United States Business as areas with high profitability and growth potential, and designated them the focused domains. This concentration will drive the group’s growth.

We have designated businesses such as the confectionery and foodstuffs businesses that are expected to report steady sales increases and higher earning power as the basic domains. They are expected to generate stably investment resources in the focused domains.

We will develop new businesses to shoulder our next-generation growth, by collectively designating the creation of business models, product development, and other new initiatives in Japan and overseas centered around wellness, as the exploration and research domain.

In order to generate investment resources in the focused domains, as well as to prepare for various management risks, we will execute structural reforms group-wide but particularly on functional sectors such as production, logistics, and sales & marketing, thereby supporting the increase in the group’s earning power.

Policy 2

Build business foundation linked with business strategies

In linkage with the business strategies aimed at achieving the 2030 Business Plan, we will maximize the resources indispensable for management, i.e., human resources, technology, cash, and digitalization, to strengthen the business foundation even further. At the same time, we will continue to reform our corporate governance and increase the transparency of management.

Policy 3

Promote diversity and inclusion

With the underlying belief in “leveraging each personʼs individuality,” we will strongly promote personnel diversity and inclusion, thereby putting in place the environment and corporate culture that will help create new values, or innovations, which in turn will lead to the resolution of social issues.

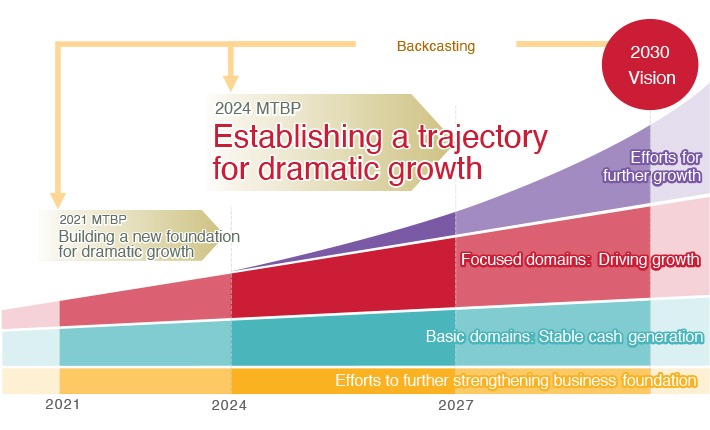

The 2024 Medium-Term Business Plan, whose initial year will be the year ending in March 2025, has been positioned as the second stage for ensuring achievement of the 2030 Business Plan, and its key message is to establish a growth trajectory for dramatic growth.

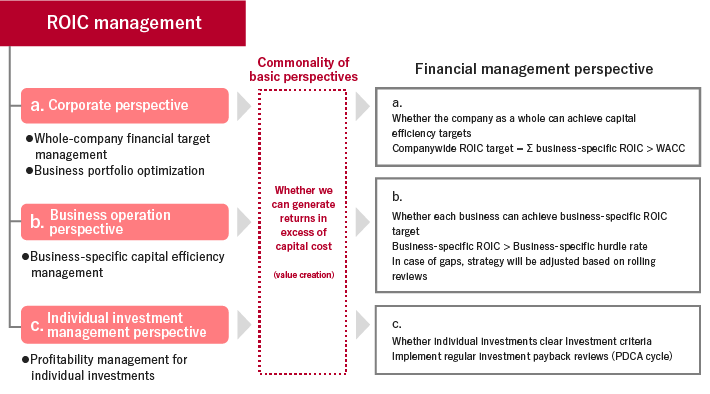

Aiming to be a sustainable company that keeps growing, we will continue to make proactive investments for growth in the focused domains and bolstering our business foundation, while promoting structural reforms centered on the basic domains and the functional sectors. Through implementing ROIC management, we will swiftly implement these strategies to create a virtuous cycle of growth and capital efficiency, thereby ensuring our growth trajectory toward 2030.

We will invest our management resources intensively in the focused domains.

This includes for the expansion of the “in-” Business centered on in Jelly, Frozen Desserts including Choco Monaka Jumbo, and Direct Marketing including Morinaga Collagen Drink, as well as for the United States Business, nurturing HI-CHEW and other and strengthening the business foundation.

In Confectionery & Foodstuffs, we will achieve a category portfolio shift by concentrating on such mainstay brands as HI-CHEW and Morinaga Biscuits and we will work to increase sales and improve capital efficiency, thereby establishing a high revenue base for this business. In doing so, we aim to create stable investment resources for the focused domains.

Centered around wellness, in Japan we will take on the challenge of entering the oral health care domain by leveraging our proprietary technologies, and we will work on cultivating the Passienol™ business, our own unique ingredient. Overseas, we will work to create markets for jelly drinks and collagen drinks, and create and nurture the seeds for our next generation of growth.

We will endeavor to improve the group’s profitability by further evolving smart factories in the manufacturing sector, improving productivity through organizational optimization of the sales sector in anticipation of market changes, and establishing a logistics system.

We will implement human capital management through diversity and inclusion, human resource development and creation of organizational culture, and promotion of health management. In R&D, we will promote the creation of value by deepening existing technologies and exploring new technologies from a global perspective. In DX, we will build a business foundation that supports business strategies in a cross-sectoral manner, such as by expanding our digital business platform and using AI technologies to make our business operations more sophisticated and efficient.

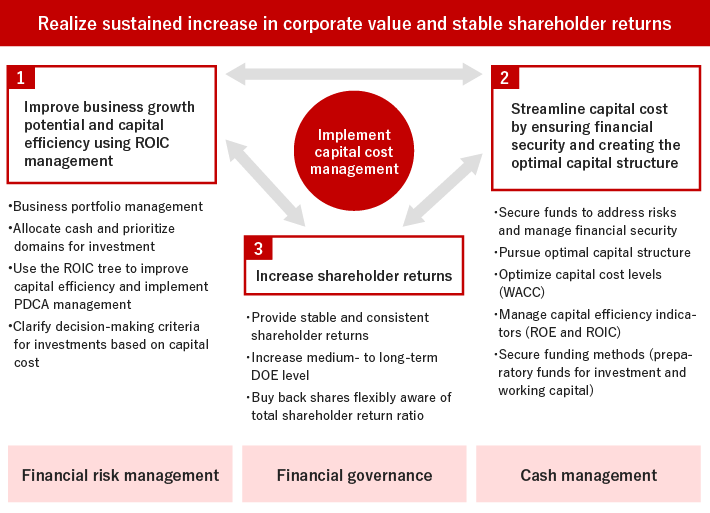

The Morinaga Group’s basic policy is to increase corporate value sustainably and achieve stable and continuous shareholder returns using proactive investments in growth and by maintaining our stable financial base.

With the aim of achieving the 2030 Business Plan, we will implement management that is aware of capital cost and stock price, as well as seek to benefit all stakeholders by maximizing corporate value.

Toward this end, we will enhance our financial management following the three main financial strategies outlined below.

The Morinaga Group will implement ROIC management and execute business strategies to grow its business portfolio in an optimal manner in order to enhance corporate value over the medium to long term.

We will analyze our business segments based on growth potential and capital efficiency to determine medium- to long-term strategies and measures for each. We will identify businesses that accelerate growth and businesses that improve capital efficiency, and allocate management resources accordingly, in terms of investment destination and investment size.

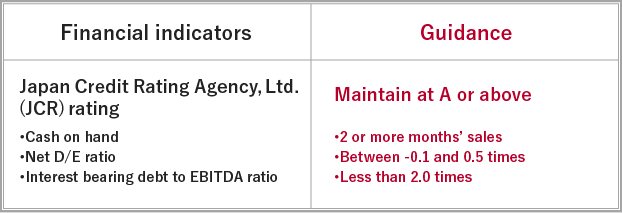

The Group's basic policy is to ensure a certain level of financial security and investment capacity in preparation for sudden changes in the external management environment and possible strategic large-scale investments (M&A, etc.).

As a general rule, our standard for financial security is to maintain a long-term credit rating of “A” or above by Japan Credit Rating Agency, Ltd. (JCR).

In addition, we will monitor financial security indicators to ensure financial security. On top of this, we will make decisions on funding to meet the demand for investment funds after holistically considering the appropriate level of cash on hand, the procurement conditions such as the level of funding costs, and the impact on financial indicators such as financial security indicators as well as ROE and ROIC.

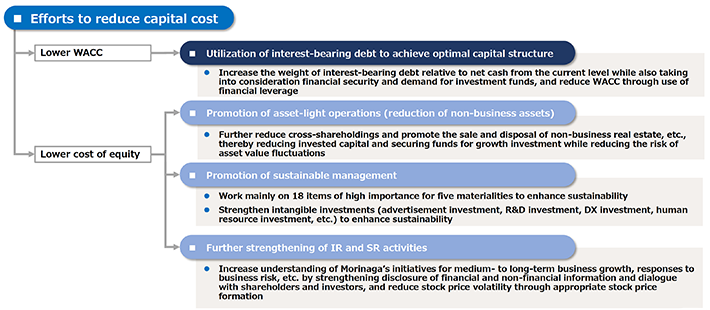

The Group will work to reduce capital cost in order to enhance corporate value. In response to the current net cash situation, we will increase the share of interest-bearing debt and utilize financial leverage to reduce the weighted average cost of capital (WACC), which we currently estimate to be around 6~7%, after assessing financial security and demand for investment funds.

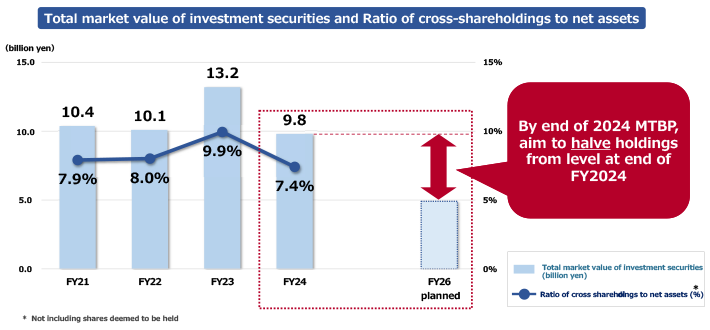

In addition, by further reducing the number of cross-shareholdings and promoting the sale and disposal of non-operating real estate,we aim to reduce invested capital, secure funds for growth investments, and reduce the risk of asset value fluctuations.We aim to halve the number of cross-shareholdings from the end of fiscal 2024 by the end of the 2024 MTBP.

The Group's basic policy is to offer stable and consistent shareholder returns backed by a solid business foundation, while prioritizing strategic and important business investments.

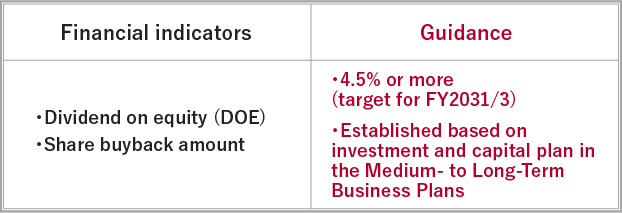

As for shareholder returns, we will seek to raise the dividend on equity (DOE), an indicator of capital policy, over the medium to long term while considering a dividend payout ratio level and free cash flow and ensuring a healthy balance sheet.

We will also consider flexibly implementing share buybacks as necessary, taking into account demand for investment funds and the total shareholder return ratio.

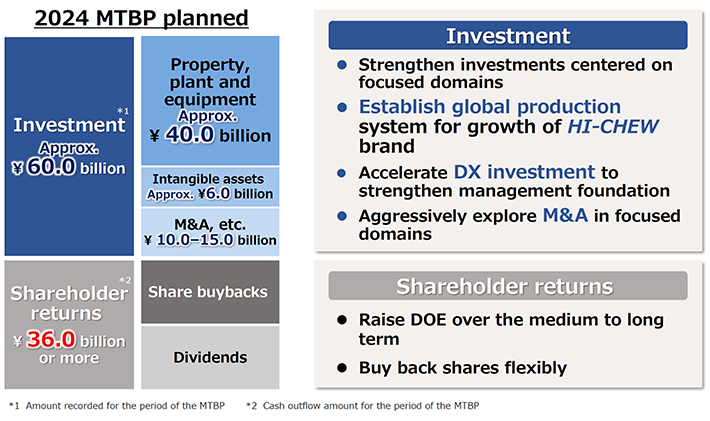

In order to create a path to achieve the 2030 Business Plan, the Group has set the theme of "Establishing a trajectory for dramatic growth" in the 2024 Medium-Term Business Plan (2024 MTBP), and will give top priority to investments centered on the focused domains.

On the other hand, with regard to shareholder returns, we will continue to strengthen our ability to generate cash from our businesses and aim to return more than 36.0 billion yen*2 during the 2024 MTBP.